As a business operator you need to make sure that you are able to deduct justifiable expenses otherwise you are giving m oney away to the tax man. One of the problems I have is ensuring that I capture those expenses in a way that lets me enter the information into my accounting software as well as meeting the ATO requirements for “written evidence”.

oney away to the tax man. One of the problems I have is ensuring that I capture those expenses in a way that lets me enter the information into my accounting software as well as meeting the ATO requirements for “written evidence”.

How the ATO defines “written evidence”

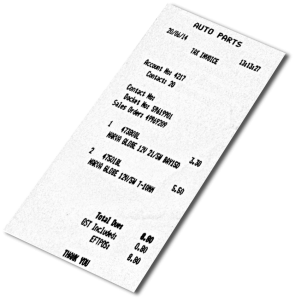

The ATO web site defines written evidence as, among other things, “paper or electronic copies of documents – these must be a true and clear reproduction of the original”. The written evidence must show the following information:

- The supplier’s name (or business name)

- The amount of the expense or cost of the asset expressed in the currency in which it was incurred

- the nature of the goods, services or asset – if not shown you may write this on the document

- the date the expense was incurred or the asset was acquired

- the date of the document

The ATO provides a page on Rules for written evidence to substantiate deductions. Also refer to TR2005/9 Income tax: record keeping – electronic records for the relevant Taxation Ruling document.

Using a mobile app to capture receipts

I’ve tried a couple of mobile apps that allow you to use the camera on your phone to capture an image of a receipt and either save it or email it. The ones I’ve tried are all about the same. Some of the free ones have limitations on the number of images stored, many can save the image to a PDF, some can do optical character recognition (OCR), and others require a subscription service. Most appear to be able to correct camera angle distortion before saving the image.

Once the image is captured, I immediately email it to myself at my “accounts@….” email address. I can do this even before leaving the store. When I am back in my office processing invoices and expenses, all my receipts are sitting in my “accounts” inbox as PDF attachments. I don’t have to search through the console of the car or the bottom of my laptop bag.

Practical Considerations

There are a few practical considerations if you intend to use electronic images to substantiate your expenses.

- The images must be “a true and clear reproduction of the original”. This means that if you can’t read the image then the ATO won’t be able to either. You need to ensure that the image has sufficient resolution to be read unambiguously. You also need to ensure that there are no shadows or highlights that obscure the information.

This really comes down to how well you capture the image. Ensure good lighting with no reflections or shadows, clean the lens on your phone’s camera, and make sure the camera is close enough to get a crisp image without cropping important information.

- The image needs to include all the required information about the supplier, the goods, and the date so don’t be too aggressive when cropping the image when saving it.

The mobile app I’ve been testing allows you to drag crosshairs on the image to identify the crop area and correct distortion when you are about to save the image. Allow a generous border around the image of the receipt when saving.

- You have a statutory obligation to store the information for a period of five years. It won’t go well if you loose the images due to a hard disk failure and are required by the ATO to produce them. You need to have an effective backup.

One great advantage a digital image has over a normal cash register receipt is that it is a permanent record. Most cash register receipts are printed using a thermal printer and the receipts themselves are very short lived even when filed in a dark, cool place such as you filing cabinet. Most of these receipts won’t be legible after about 12 months anyway so storing them as an image is a good idea.

Secondly, if you email the receipt from you mobile device you will have a copy of the PDF on you phone and in your inbox so you already have two copies. If you save the PDF in an Accounts Payable folder on your computer then you have three copies. If you use a cloud storage sync/backup utility to sync your Accounts Payable folder then you have four copies of the receipt. As long as you don’t delete all four copies, you’ll still have a copy five years from now.

- When requested, the information must be able to retrieved in a format suitable to the ATO.

I really like the idea of storing the image in a PDF file. The PDF file format isn’t going away so your files will always be readable.

I think that you’ll find this hack to be a great time saver.

Do you use any particular app that really shines in this area?